Life Insurance for Someone Who Had a Heart Attack

Heart attacks and life insurance

Is it possible to get life insurance for someone that had a heart attack? There are now several life insurers that will make favorable offers: sometimes as good as a standard rate for life insurance.

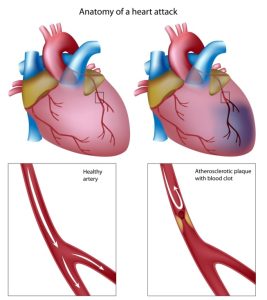

At it’s most basic, a heart attack (myocardial infarction) is when heart muscle cells become severely damaged due to lack of oxygen. This happens when oxygen carrying blood is dramatically reduced or cut off entirely to some of the heart muscle. The blood restriction is usually caused by a clot that forms on broken off plaque.

So in summary, here is the three step process to developing a heart attack:

- allow plaque to form from fatty deposits in coronary arteries as this will narrow the arteries

- allow a clot to form around a piece of broken off plaque

- let the clot get clogged in a narrow coronary artery

- This clot can now shut down oxygen carrying blood flow to some heart muscle, and viola you have damaged heart muscle.

Why is damaged heart muscle a problem?

Damaged heart muscle heal by forming scar tissue. This scar tissue does not work as good as normal heart tissue. As a result, the heart will have to compensate in order to keep up with the body’s requirement. This extra work can cause the heart to build up extra muscle and become stiffer. The stiffer (less elastic heart) may eventually not be able to pump the required blood resulting in heart failure.

How do life insurers decide what rating to apply

An applicant who has suffered a heart attack (myocardial infarction) is individually underwritten using multiple factors:

- age when episode(s) occurred

- the degree of coronary artery disease

- which vessels have been damaged

- treatments and medications

- other medical conditions such as hypertension, kidney disease, diabetes

Who has the best chance of receiving a favorable life insurance rating?

- Someone who had a single episode after the age of fifty, and

- has a single blood vessel disease

- normal left ventricle function

- improved cardiac risk factors

What rate class could someone really expect?

It depends on all the risk factors of course. But, a typically someone that had heart attack after age 40 could expect an increase of 100-200%.

Most companies will decline someone who had an episode prior to age 40. If they are declined for regular underwriting there are usually ‘guaranteed issue’ plans available. Guaranteed issue plans have limited death benefits for first few years.

RATE A CASE NOW LEARN HOW TO HANDLE IMPAIRED LIFE CASE