Life Insurance for Someone with Crohn’s Disease

Crohn’s disease and life insurance

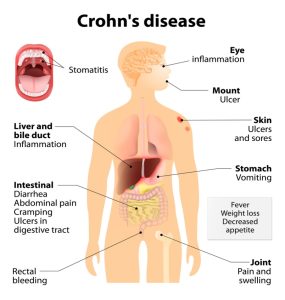

According to The Crohn’s and Colitis Foundation Crohn’s disease affects about 700,000 people in the United States. Crohn’s disease is a chronic inflammatory bowel disease. Sometimes called regional enteritis. There may be inflammation of any part of the gastrointestinal tract from mouth to anus. Inflammation can spread into many layers of the affected tissue.

Commonly affected areas are the terminal ileum, colon and anorectal regions. Clinical features include chronic diarrhea, abdominal pain, fever, anorexia, and weight loss. Crohn’s disease is most often diagnosed between the ages of 20 – 40.

Treatment is similar to that of ulcerative colitis. However, over half of Crohn’s patients will need some surgical intervention within 5 years. Because the entire gastrointestinal tract can be involved, surgery is not curative and recurrences following surgery are common.

Why are life insurance companies concerned with Crohn’s disease?

Aside from Crohn’s disease being painful, it can lead to life threatening complications. Common complications include bowel obstructions, ulcers, fistulas, anal fissures, colon cancer, and malnutrition. There is an increased risk of colon cancer if the disease has been present over 15 years. Consequently underwriters believe there is a risk of increased mortality.

What do underwriters want to know in order to offer a risk assessment?

- age at diagnosis

- the frequency of episodes

- if stable, how long stable

- list of any treatments, medications, or hospitalizations

Expected ratings can be from standard to decline depending on severity.

- an underwriter will probably be postpone any case within six months of diagnosis

- after six months is symptoms are stable the rating would be 50-75%

- a single episode over 10 years ago could be standard

- evidence of sclerosing cholangitis or dysplasia on biopsy

RATE A CASE NOW

LEARN HOW TO RATE IMPAIRED LIFE CASES