Life Insurance for someone with Colorectal Cancer

Colorectal cancer and life insurance

Someone with colorectal (colon or rectum) cancer may find it difficult to get affordable life insurance. Many life insurers look unfavorably at people with some colorectal caners because the statistics show that a certain percentage of these people will die prematurely.

According to The American Cancer Society Colorectal cancer is the third most common internal cancer in the US, and the third leading cause of cancer death.

If the cancer is caught early, when it hasn’t penetrated past the innermost layer of the intestine, the long em prognosis is most favorable. And at this stage some insurers may even offer standard rates. Once the tumor has progressed past the innermost layer insurers may decline the case or charge extra premium for a number of years.

How did this cancer get started?

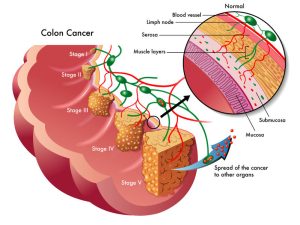

Most colorectal cancer start as a benign polyp. A polyps starts as a benign growth, but can develop for a period of years into a cancerous growth. It is estimated that ten percent if these polyps will develop into cancerous growths. And this is where it starts to get serious. As mentioned earlier, if the cancer is caught at its earliest stage (in the innermost layer of the colon) the risk is minimized. The risk of premature death seems to increase the more the cancer spreads. It can spread from the innermost layers to the outermost layers, and from there it can penetrate the lymph nodes. It can also break away from the local cancer and spread to other parts of the body via the lymph system or via the blood stream.

What life insurers want to know in order to offer a rating for life insurance?

Insures will look at the staging of the cancer to determine where it has spread and if it is affecting other organs. Additionally, underwriters will want to know the timeline of the diagnosis and treatment, and the treatment type(s).

Because insurers experience in these cases varies so do the subsequent offers. So it is best to intelligently ‘shop’ the market for the best rates. Underwriters can make offers as good as standard in some cases, but a declination is likely in late stage cancers.

A declined person can apply for a ‘graded death benefit’ plan. These plans offer limited death benefits the first few years.

How to get the most favorable life insurance rate for someone with colorectal cancer

There is good news for people with colorectal cancer. First, more people age 50 to 70 are getting screened for colorectal cancer. Which means polyps will be caught before they turn cancerous, and cancers will be caught at earlier stages. So the long term prognosis will be better, and hence the life insurance rates will be more favorable.

Every case is different and different insurers will have varying views and rates. And not only that, but the views of the insurers evolve over time so the rate they offer today could be different than what they might offer a year from now. One may get lucky and apply to a life insurer that offers a favorable rating. But why take the chance when you can work with an independent agent that has access to multiple insurers. They can then present this particular case to multiple companies in order to get the most favorable offer.

LEARN HOW TO RATE IMPAIRED LIFE CASES